Texas Accountants and Lawyers for the Arts believes that all creatives — regardless of income or background — deserve access to the business knowledge and advice necessary to grow a career in the arts.

Our programs are designed to help participants apply sound business practices to protect intellectual property, advance careers, and develop income.

CONNECT WITH US!

Join our mailing list for information about upcoming events and additional resources for artists and creatives.

WHO DO WE HELP?

TALA’s signature pro bono services are offered to financially qualified artists, arts nonprofits, and inventors in all creative disciplines.

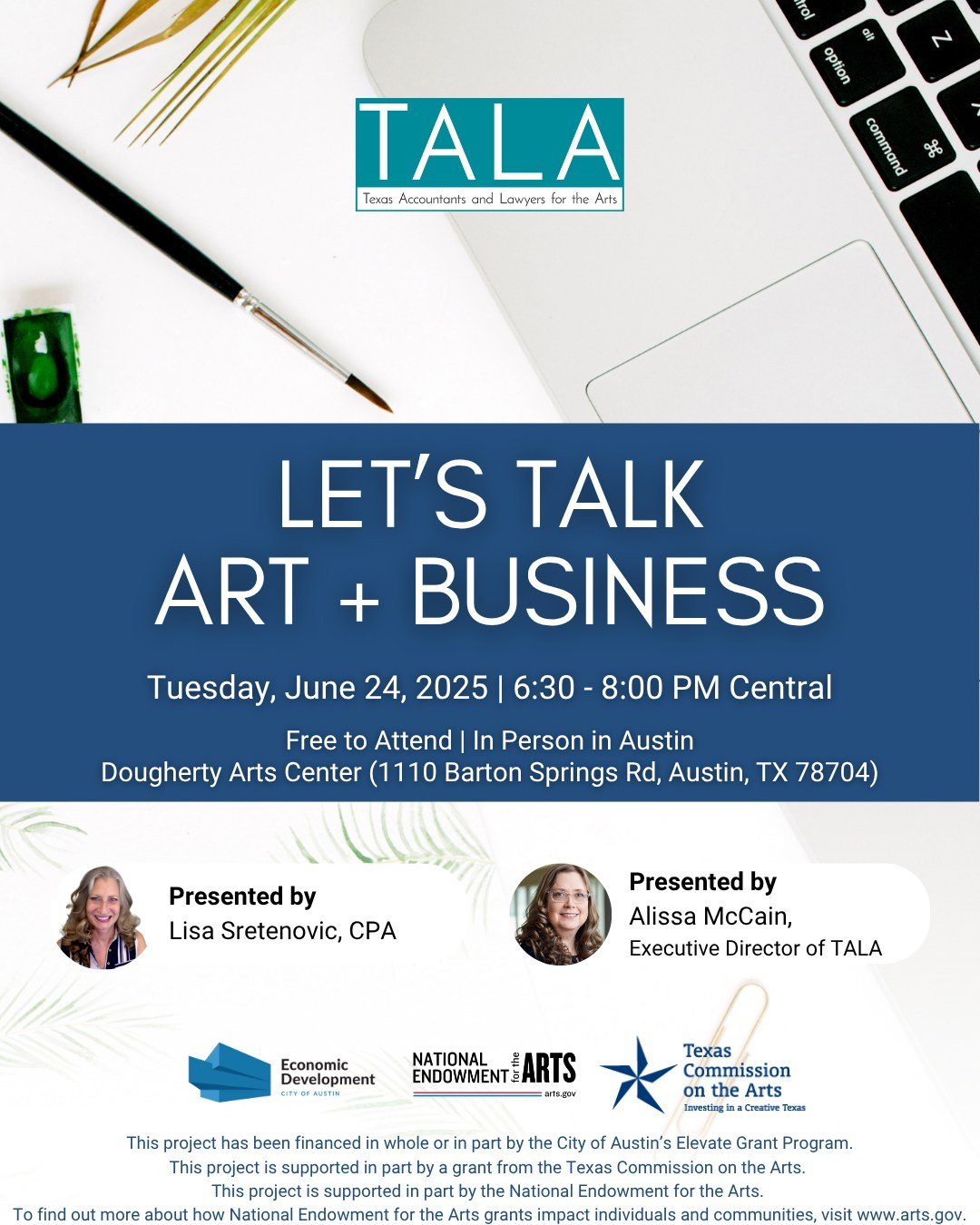

TALA’s educational programming is free and open to the public.

Pro bono legal and accounting assistance for artists and arts nonprofits.

Pro bono patent assistance for inventors and creatives.

Free educational programming for the artistic and business communities.