a

Did you miss the Art of Taxes webinars? View the recordings on our Youtube channel, Tala Office.

Click Here for The Art of Taxes Part 1

Click here for The Art of Taxes Part 2

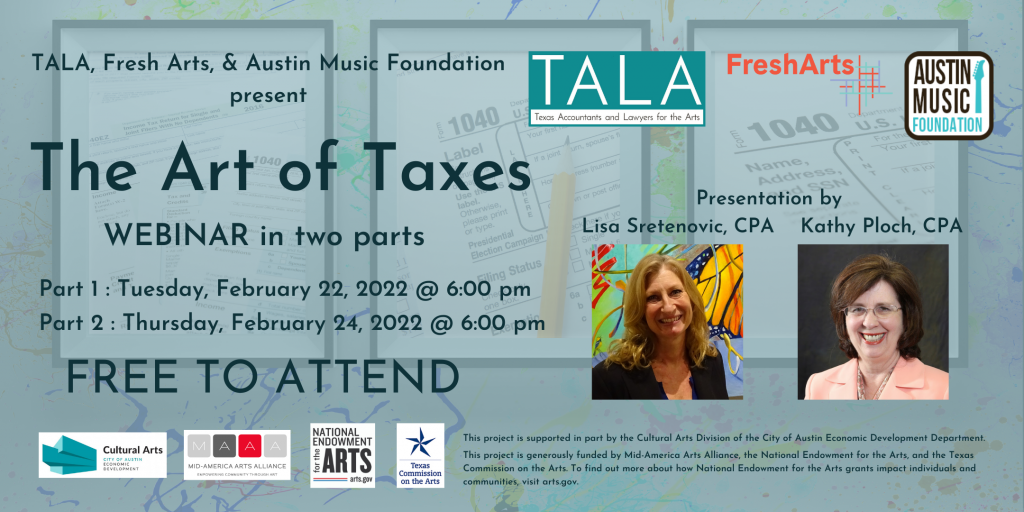

Presented in partnership with Fresh Arts and Austin Music Foundation

a

TALA’s popular annual seminar is back for 2022 with a two-part online webinar

featuring TWO CPA’s. Join us for both nights to get the complete content.

It’s important to be up to date with information that impacts your tax liability. We’ll

cover the usual tax basics plus additional topics such as relief aid payments, SBA

program funds, unemployment, charitable deductions, the child tax credit, and more.

Structured with artists in mind, this seminar is designed to walk you through your tax return, addressing common artist concerns and important IRS regulations pertaining to creative practices.

Part 1 on February 22 will cover:

- What it means to be self-employed/independent contractor

- Business structure overview

- Keeping records of income and expenses

- Forms 1099 and W-9

- Combination of W-2 and 1099 tax reporting

- Business v Hobby rules as applied to tax

- How to report unemployment, PPP loans, and relief aid on individual tax returns. (Will also be covered in part 2)

Register here for Part 1

a

Part 2 on February 24 will cover:

- What’s deductible?

- What the self-employment tax is and how it is paid?

- Using the Section 199(A) passthrough

- Estimated tax payments

- Other taxes – Sales, Franchise, Business Personal Property

- Information on the child tax credit, charitable deductions, and student loans

- How to report unemployment, PPP loans, and relief aid on individual tax returns. (Will also be covered in part 2)

Register here for Part 2

a

Meet the speakers

Kathy Ploch, CPA

Kathy is a CPA at Durio and Company P.C. She previously spent 7 years as a Tax Compliance and Consulting Specialist at Harper & Pearson Company, P.C. She has been in public accounting preparing all types of taxes for 35 years and has worked with small nonprofit organizations for 20 years. Kathy is a Past President of TALA and has been a volunteer with the organization since 1999. She is a member of the Houston CPA Society and served as the Society’s President in 2009-2010.

Lisa Sretenovic, CPA/CITP/CGMA

Lisa is a business coach competent in accounting, finance, and management. She is also skilled in strategic planning/budgeting, analysis, process improvement, and training. As a result of her work in varied industries (public accounting/tax, professional practices, real estate investment, SaaS, telecommunications, manufacturing, hospitality, music production, and oil & gas), she possesses experience that is broad and allows knowledge application from one area to others. One of her strongest abilities is to communicate complex financial information in a language appropriate for the audience, from the board of directors to the IT department or the director’s assistant to the small business owner. Her specialties include financial consulting for small & start-up companies focusing on the business owner’s financial literacy and how that improves business growth. Lisa is a current professional volunteer for artists and arts organizations through TALA and is a past TALA board member.

This project is generously funded by the Mid-America Arts Alliance, the National Endowment for the Arts and the Texas Commission on the Arts. To find out more about how National Endowment for the Arts grants impact individuals and communities, visit arts.gov.

This project is supported in part by the Cultural Arts Division of the City of Austin Economic Development Department.