The Art of Taxes

Structured with artists in mind, this seminar is designed to walk you through your tax return, addressing common artist concerns and important IRS regulations pertaining to creative practices.

Brush Up For The New Year

Listen up, artists! 📣 2026 is around the corner, so it’s the perfect time to brush up on all of the knowledge you’ll need to be compliant with taxes and reporting. Join TALA’s resident CPA Lisa Sretenovic for an engaging webinar. Participants will learn how to:

Categorize Tax-Deductible Business Expenses

Prepare for 1099s

File the Texas Information Report and Business Personal Property Tax Rendition

and more!

Let’s Talk Art + Business

Join CPA Lisa Sretenovic and TALA Executive Director Alissa McCain as they dive into some of the most frequently asked questions TALA receives from visual artists. From managing taxes to structuring your business to registering intellectual property, Lisa and Alissa will offer insights and practical tips to help you build a sustainable and successful creative practice.

Gig to Gross: Bookkeeping Basics for Musicians

We are partnering with A&R Foundation to bring you Gig to Gross: Bookkeeping Basics for Musicians Who Want To Know Where There Money Goes. You can join us online on Thursday, May 29 from 6:00 - 8:00 PM Central while TALA's resident CPA, Lisa Sretenovic, walks musicians through how to use the free program Wave to manage their finances. We can't wait to see you there!

The Art of Taxes

Structured with artists in mind, this seminar is designed to walk you through your tax return, addressing common artist concerns and important IRS regulations pertaining to creative practices.

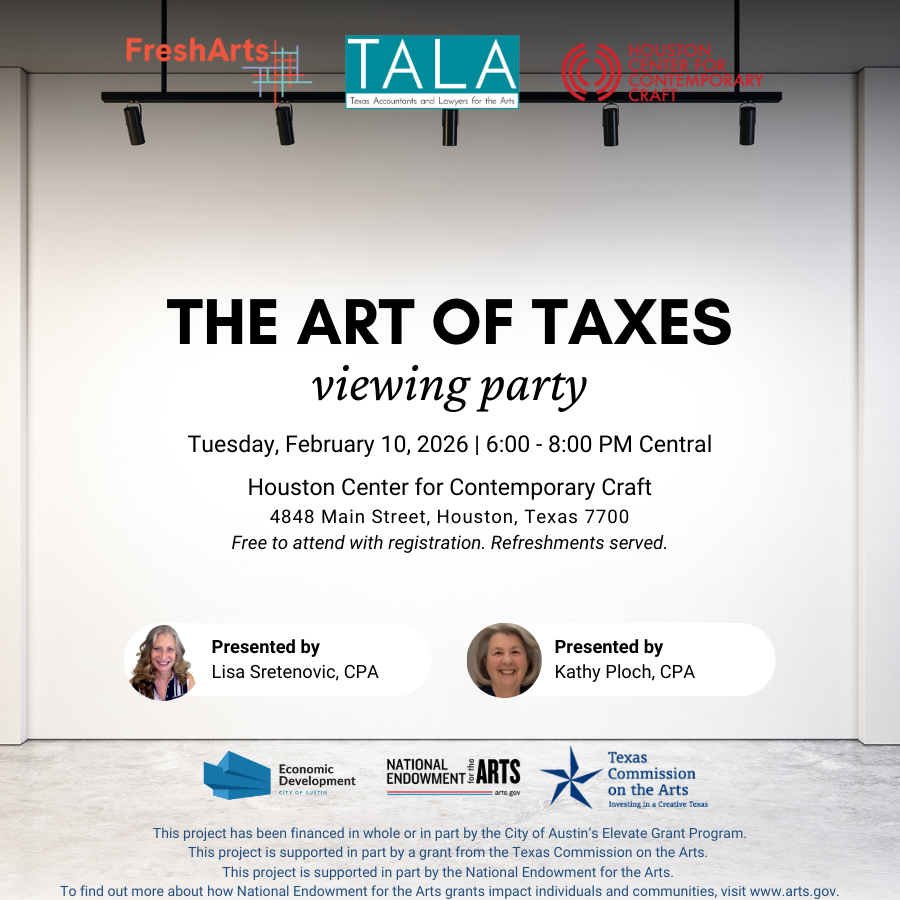

The Art of Taxes Viewing Party

HCCC is hosting a viewing party to watch TALA’s “The Art of Taxes 2025” livestream event! Enjoy refreshments, and connect and network with fellow artists, while CPAs Kathy Ploch and Lisa Sretenovic guide you through your tax return, addressing common concerns for artists and important IRS regulations related to creative practices.

Brush Up For The New Year: Regulatory Compliance Made Easy For Artists

Listen up, artists! 📣 2025 is around the corner, so it’s the perfect time to brush up on all of the knowledge you’ll need to be compliant with taxes and reporting. Join TALA’s resident CPA Lisa Sretenovic for an engaging webinar. Participants will learn how to:

Categorize Tax-Deductible Business Expenses

Prepare for 1099s

Reporting the Beneficial Ownership Information with FinCEN

and more!

The Artist's Account: Balancing Creativity and Cashflow

Many artists struggle with inconsistent pay amounts and various timing of income which makes it difficult to maintain accurate records, much less to predict and plan for the future. This seminar will provide advice on creating and maintaining simple, yet powerful, spreadsheets and data to keep your financial picture in check and help predict and improve future performance.

Art of Taxes 2024

Artists: stay up to date with information that impacts your tax liability. Structured with artists in mind, this seminar is designed to walk you through your tax return, addressing common artist concerns and important IRS regulations pertaining to creative practices

Year-End Tax & Business Wrap Up

Master W9s, deductions, and 1099s to make your business tax savvy. Take a moment to reflect on your 2023 business goals and plan ahead for the upcoming year. TALA’s resident CPA, Lisa Sretenovic, shares valuable tips to ensure you’re ready for tax season and beyond.

IRS Form 990 Walkthrough with a CPA

We’re ending our nonprofit series by breaking down some of the most important knowledge a nonprofit leader could possess… How to complete an IRS Form 990 charitable organization tax return.

Whether your organization files the 990 itself or pays a CPA, every nonprofit leader should recognize the critical reporting items. Understanding what’s expected by the IRS makes end of year reporting easier and ensures compliance with maintaining 501c3 status.

Transparency Matters: Demystifying Audits for Nonprofit Organizations

Are you confused about nonprofit audits? Does your nonprofit need one and when? What’s going to happen once an auditor is engaged? Will an audit help you raise funds? What can you expect to learn from an audit? How do you find an affordable CPA for the audit process?