Events

TALA develops and hosts workshops and seminars covering copyright, trademark, contracts, taxes, business entities, budgeting, risk management, and other topics relevant to creative practices.

All events are free and open to the public.

Upcoming Events

Past Events

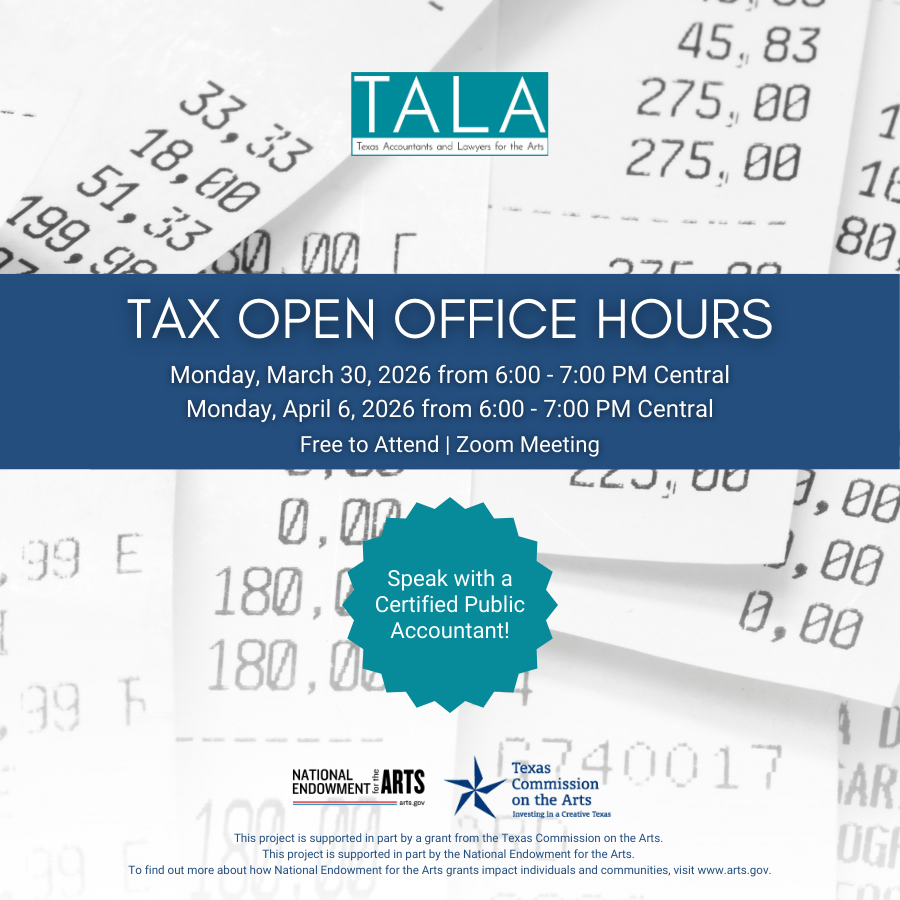

Tax Open Office Hours

As the tax deadline looms, you may have last minute questions for a CPA.

We’ve got you covered.

If you have questions about your personal tax filing, make sure you join us at our free Tax Open Office Hours on March 30 or April 6, from 6:00 to 7:00 PM Central.

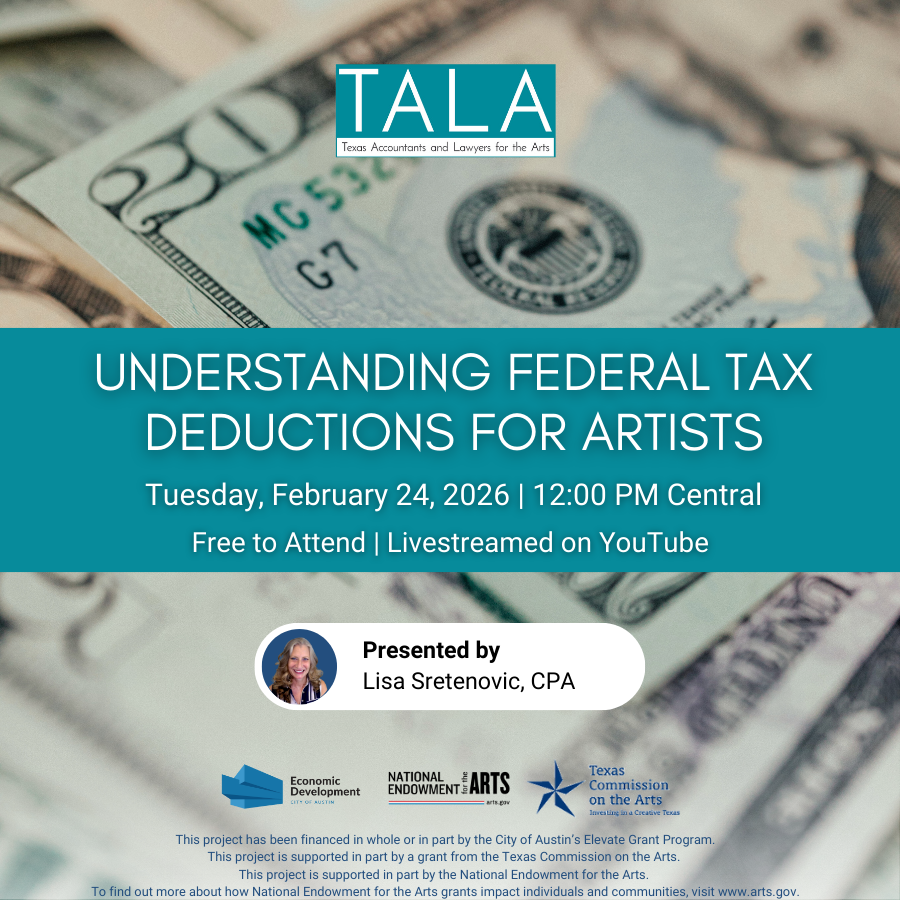

Understanding Federal Tax Deductions for Artists

As a component of the 2026 The Art of Taxes program, TALA will offer a dedicated workshop addressing federal tax deductions common to artistic and creative practices. This practical online workshop covers federal tax deductions available to artists and creative professionals, including home office expenses, supplies and materials, travel, marketing and promotion, equipment, and other business-related costs.

The Art of Taxes

Structured with artists in mind, this seminar is designed to walk you through your tax return, addressing common artist concerns and important IRS regulations pertaining to creative practices.

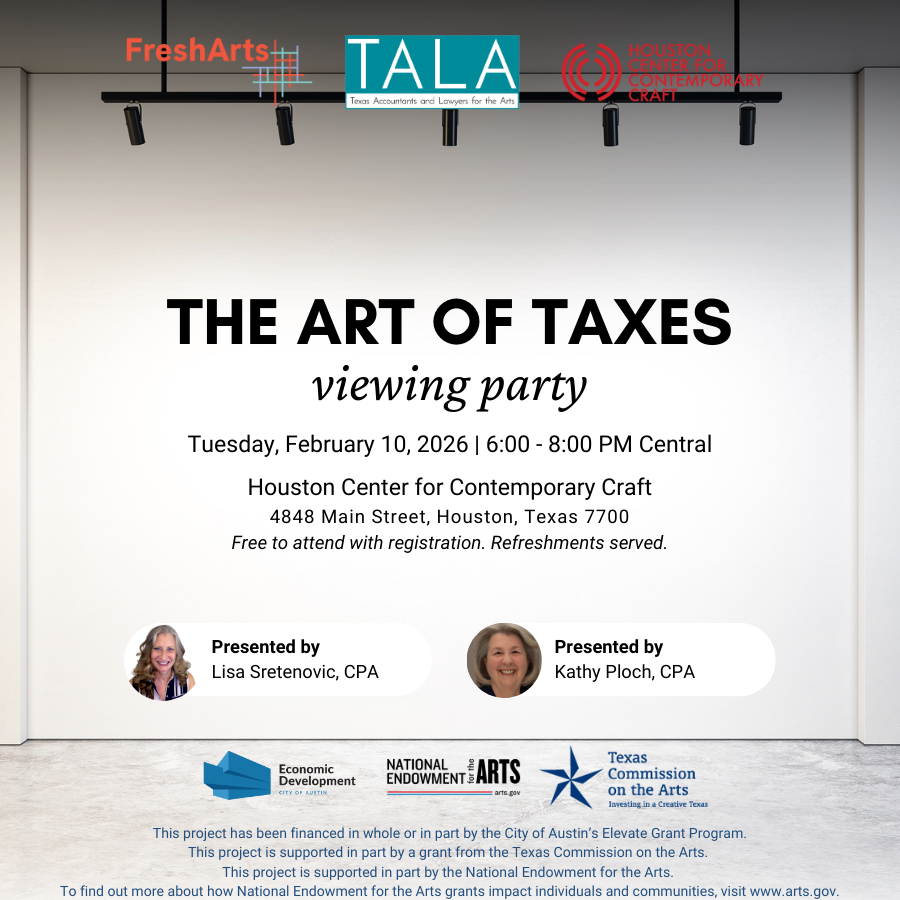

The Art of Taxes Viewing Party

HCCC is hosting a viewing party to watch TALA’s “The Art of Taxes 2026” livestream event! Enjoy refreshments, and connect and network with fellow artists, while CPAs Kathy Ploch and Lisa Sretenovic guide you through your tax return, addressing common concerns for artists and important IRS regulations related to creative practices.

Small Claims Court for Creatives

As an independent artist, musician, or small business owner, you may encounter situations where someone won't pay you, won't return your gear, damages your stuff, or otherwise breaks an agreement. When this happens, there are self-help legal options you can use to demand compensation. Join attorneys and advocates from Texas Accountants and Lawyers for the Arts (TALA), the Austin Community Law Center (ACLC), and Austin Texas Musicians (ATXM) for a discussion on what you can do to get paid.

Brush Up For The New Year

Listen up, artists! 📣 2026 is around the corner, so it’s the perfect time to brush up on all of the knowledge you’ll need to be compliant with taxes and reporting. Join TALA’s resident CPA Lisa Sretenovic for an engaging webinar. Participants will learn how to:

Categorize Tax-Deductible Business Expenses

Prepare for 1099s

File the Texas Information Report and Business Personal Property Tax Rendition

and more!

Personal Finance for Artists

Transform your approach to money so it becomes less of a stress point and more of a practical tool for reaching your creative goals. Join CPA and TLF Advisor Lisa Sretenovic as she introduces a simple money management system to bring clarity and strengthen your financial foundation. You’ll walk away with a new mindset, renewed confidence, and an actionable plan to build long-term financial stability.

Grant Application Assistance Hangouts

We are thrilled to partner with our friends at the Museum of Human Achievement to host SEVEN Grant Application Workshops for individuals or organizations seeking assistance with applying to the City of Austin Art, Culture, Music, and Entertainment (AACME) Funding Programs.

These workshops will offer an overview of this year's application, 1:1 support, and a friendly environment to co-work with other community members on your applications.

Arts Legal Line

Participants can call from anywhere in Texas between 5:30 and 7:30 p.m. to get arts related questions answered by a TALA volunteer attorney.

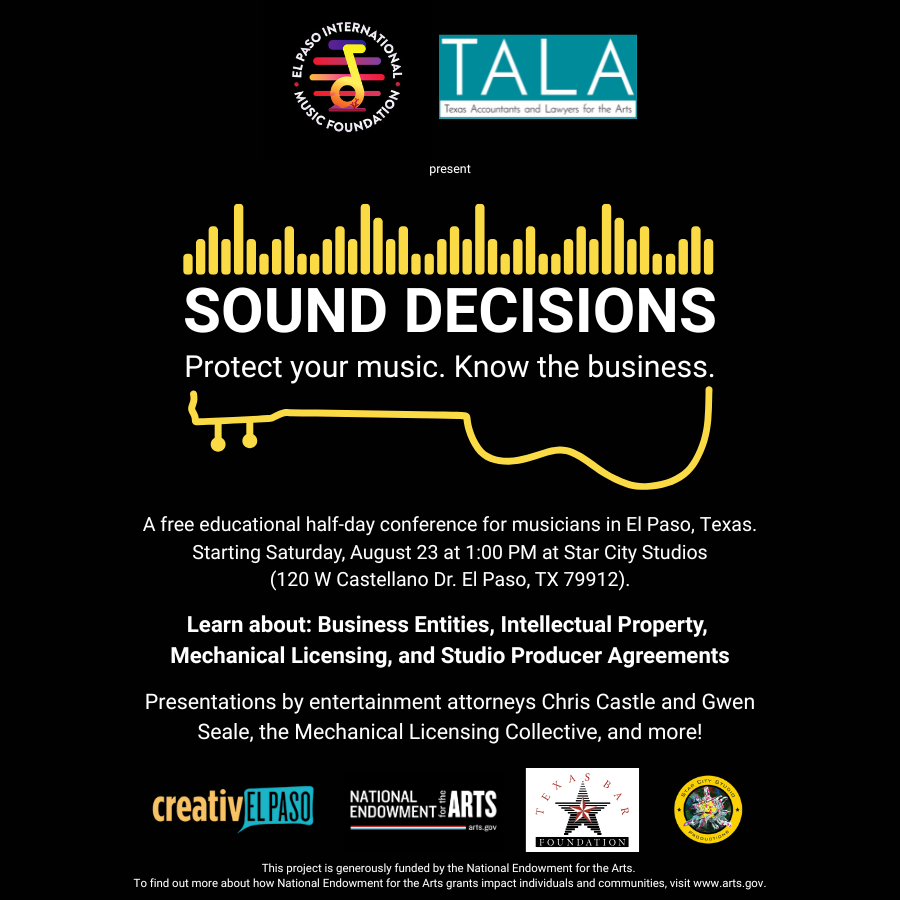

Sound Decisions

Join us for Sound Decisions: Protect Your Music. Know The Business., a half-day event for music creators looking to navigate the business side of the music industry with confidence. Hear from legal experts, get practical guidance, and connect with fellow artists and professionals. Stick around after the workshops for a casual reception with drinks and light bites. Free to attend!

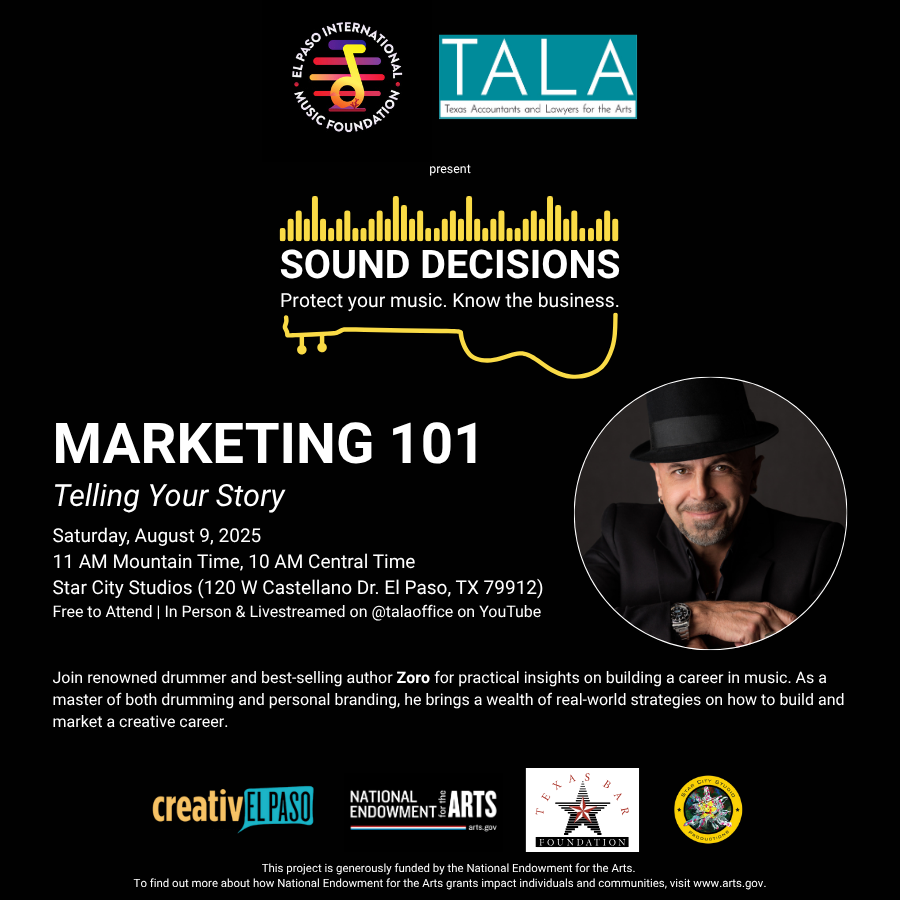

Marketing 101: Telling Your Story

Renowned drummer and best-selling author Zoro will share practical insights on building your brand and making your voice heard. Learn how to clearly communicate who you are, what you do, and why it matters — and why that’s essential to growing your audience and opportunities.

Let’s Talk Art + Business

Join CPA Lisa Sretenovic and TALA Executive Director Alissa McCain as they dive into some of the most frequently asked questions TALA receives from visual artists. From managing taxes to structuring your business to registering intellectual property, Lisa and Alissa will offer insights and practical tips to help you build a sustainable and successful creative practice.

Arts Legal Line | June 2025

Participants can call from anywhere in Texas between 5:30 and 7:30 p.m. to get arts related questions answered by a TALA volunteer attorney.

Gig to Gross: Bookkeeping Basics for Musicians

We are partnering with A&R Foundation to bring you Gig to Gross: Bookkeeping Basics for Musicians Who Want To Know Where There Money Goes. You can join us online on Thursday, May 29 from 6:00 - 8:00 PM Central while TALA's resident CPA, Lisa Sretenovic, walks musicians through how to use the free program Wave to manage their finances. We can't wait to see you there!

Tax Open Office Hours

If you have questions about your personal tax filing, make sure you join us at our free Tax Open Office Hours!

Protecting Creativity In The Digital Era

Designed for creators, inventors and makers, as well as their business & legal counsel, this free in-person event offers attendees a chance to hear directly from representatives from the US Copyright Office as they provide insights into the intersection of intellectual property law, technology and entertainment.

The Art of Taxes

Structured with artists in mind, this seminar is designed to walk you through your tax return, addressing common artist concerns and important IRS regulations pertaining to creative practices.

The Art of Taxes Viewing Party

HCCC is hosting a viewing party to watch TALA’s “The Art of Taxes 2025” livestream event! Enjoy refreshments, and connect and network with fellow artists, while CPAs Kathy Ploch and Lisa Sretenovic guide you through your tax return, addressing common concerns for artists and important IRS regulations related to creative practices.

Arts Legal Line | February 2025

Participants can call from anywhere in Texas between 5:30 and 7:30 p.m. to get arts related questions answered by a TALA volunteer attorney.

Brush Up For The New Year: Regulatory Compliance Made Easy For Artists

Listen up, artists! 📣 2025 is around the corner, so it’s the perfect time to brush up on all of the knowledge you’ll need to be compliant with taxes and reporting. Join TALA’s resident CPA Lisa Sretenovic for an engaging webinar. Participants will learn how to:

Categorize Tax-Deductible Business Expenses

Prepare for 1099s

Reporting the Beneficial Ownership Information with FinCEN

and more!

Intellectual Property Roadshow: San Antonio

Join Texas Accountants and Lawyers for the Arts, the United States Patent and Trademark Office, the Intellectual Property Law Section of the State Bar of Texas, and numerous local partners as we bring Intellectual Property to YOU! We will be visiting San Antonio on Thursday, October 17 for a day of in-person sessions designed to help you navigate patents, trademarks, copyright, and trade secrets.

Intellectual Property Roadshow: Corpus Christi

Join Texas Accountants and Lawyers for the Arts, the United States Patent and Trademark Office, the Intellectual Property Law Section of the State Bar of Texas, and numerous local partners as we bring Intellectual Property to YOU! We will be visiting Corpus Christi on Wednesday, October 16 for a day of in-person sessions designed to help you navigate patents, trademarks, copyright, and trade secrets.

Copyright for Visual Artists

Did you know that a single piece of artwork can generate multiple revenue streams? Join the Capitol View Arts 2024 Creative Entrepreneur Cohort and TALA for an insightful discussion on copyright of visual art.

The Artist's Account: Balancing Creativity and Cashflow

Many artists struggle with inconsistent pay amounts and various timing of income which makes it difficult to maintain accurate records, much less to predict and plan for the future. This seminar will provide advice on creating and maintaining simple, yet powerful, spreadsheets and data to keep your financial picture in check and help predict and improve future performance.

Art Smart Business for Creatives

Pursuing your art is one thing - managing the business side is another! This seminar will cover a spending plan for your artistic business and how it relates to your personal budget, why it’s important to compartmentalize your artistic business spending and your personal spending, and what information should be tracked for accurate tax reporting.

Art of Taxes 2024

Artists: stay up to date with information that impacts your tax liability. Structured with artists in mind, this seminar is designed to walk you through your tax return, addressing common artist concerns and important IRS regulations pertaining to creative practices

Copyright Seminar & Registration Clinic

TALA is partnering with our friends at Capitol View Arts and Big Medium to host a copyright seminar and clinic! If you’re in Austin and need to register a copyright, join us on Tuesday, January 30 from 6:00 PM to 9:00 PM Central at the new Big Medium exhibit space.

Year-End Tax & Business Wrap Up

Master W9s, deductions, and 1099s to make your business tax savvy. Take a moment to reflect on your 2023 business goals and plan ahead for the upcoming year. TALA’s resident CPA, Lisa Sretenovic, shares valuable tips to ensure you’re ready for tax season and beyond.

IRS Form 990 Walkthrough with a CPA

We’re ending our nonprofit series by breaking down some of the most important knowledge a nonprofit leader could possess… How to complete an IRS Form 990 charitable organization tax return.

Whether your organization files the 990 itself or pays a CPA, every nonprofit leader should recognize the critical reporting items. Understanding what’s expected by the IRS makes end of year reporting easier and ensures compliance with maintaining 501c3 status.

Transparency Matters: Demystifying Audits for Nonprofit Organizations

Are you confused about nonprofit audits? Does your nonprofit need one and when? What’s going to happen once an auditor is engaged? Will an audit help you raise funds? What can you expect to learn from an audit? How do you find an affordable CPA for the audit process?